stocks i hold in 2025

have been investing with a gut feeling.

| sym | P/L | alloc | yield | |

|---|---|---|---|---|

| 1 | NET | +154% | 36.8% | |

| 2 | VOO | +50% | 33.4% | 1.19% |

| 3 | MSFT | +80% | 14.4% | 0.66% |

| 4 | PFE | -15% | 5.9% | 6.95% |

| 5 | MCD | +17% | 3.2% | 2.26% |

| 6 | NKE | -12% | 3.1% | 2.07% |

| 7 | MDB | +23% | 2.7% | |

| 8 | FIG | -11% | 0.5% |

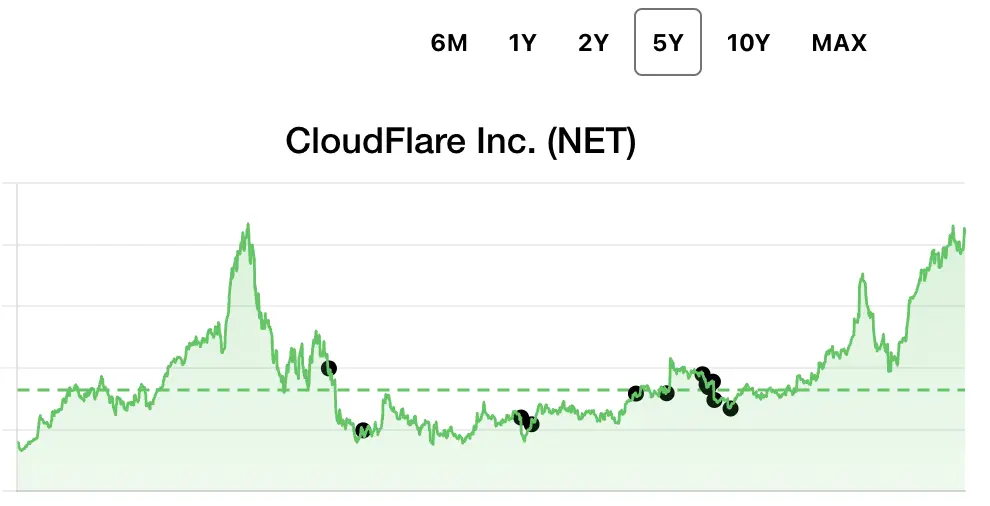

1. NET (CloudFlare)

when i realised cloudflare is a public company back in like 2021, it was at its peak and couldn't dare to buy. bought some dips when it tanked. never questioned it's ubiquitous presence in tech industry, and future potential it's going to reach. cloudflare has been already prominent market leader on its own league in my opinion. bought some more as much as i could without injecting further cash. held for few years and glad it helped me recover all my previous losses.

2. VOO (S&P 500 Vanguard ETF)

safe bet. when i first started investing, my plan was to hold this sort of etfs up to around 70%. soon didn't get satisfied with the slow and steady growth of double digits. started to pick individual stocks as this etf made it seem too easy and boring which didn't turn out well. voo is showing a good return so far. much better than i anticipated. in retrospect, shoud've invested in the etf more. would've bought recent dips if i had any cash.

3. MSFT (Microsoft)

have been very bullish from the beginning of my investment journey despite their continuous all-time highs. they own so much of developer ecosystem, and are one of the three big cloud providers. there are so many things that can still be digitised and go online in the future. there will be more needs of servers in the future never any less. didn't invest as much as i believed their future is worth though.

4. PFE (Pfizer)

google deepmind has shown what ai can do in chemistry. i predict ai can make some breakthroughs in medicine and cut the cost of r&d significantly. just not sure which company is going to benefit from this future. having a negative return from pfizer so far. has good yield though.

5. MCD (McDonald's)

think it's going to continue to grow. mostly for their real estate dominance over other fast food chains.

6. NKE (Nike)

thought it was down and would go up eventually. kinda impulsive buying.

7. MDB (MongoDB)

not a big fan of mongodb and nosql. but still think it's going to hold it's fame for a while. looking for timing to sell to rebalancing.

8. FIG (Figma)

winning designing tool that looks promising although i have never used it. would like to increase my allocation gradually.